Table of Contents

For those of you who are just tuning in, or slept through the opening of 2021, here is everything you ever needed to know abut the GameStop saga, why it matters, and what is going to happen next.

But First….Media Myths

The David and Goliath narrative is only partially true.

We are still watching ‘Billionaire Wars’ unfold. There is big institutional money on both sides of the bet.

Fidelity and BlackRock own millions of GameStop shares each. That might explain why the few brokerages allowing the purchase of GameStop in late January was Fidelity and Vanguard.

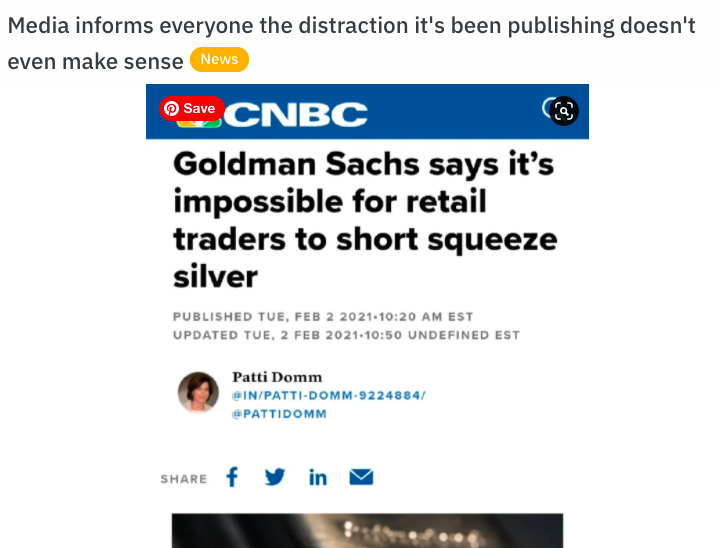

Silver is next?

No – silver is not capable of being ‘squeezed’, nor does r/WallStreetBets care about silver. There is speculation this is a media rumor caused by Citadel – who owns large amounts of silver contracts (SLV) – to distract from the real issue at hand.

Whatever ripe investment play is coming next, you aren’t going to find it by listening to any mainstream news channel. There are also fake bot accounts promoting silver in R/WallStreetBets.

The WSB Subreddit didn’t ‘conspire’ as an ‘angry mob’ to bring down the financial industry.

The financial industry brought itself down (almost) by making questionable decisions.

Reddit investors found a deep value play and seized it. Quickly afterwards, options traders spotted a squeeze, and piled on.

What no one is paying attention to in the GameStop story is the principles of deep value investing. In fact, the Reddit user who predicted (created?) this momentous GameStop saga’s very Reddit handle is ‘DeepF******Value’.

If you want to learn more about why deep value investing is amazing, I wrote a post about that for you here.

Is this hurting Grandma’s 401k?

Unlikely. Unless, your Grandma is a super successful accredited investor. Then, I hope your Grandma knows the risk she’s getting into.

The hedge funds in this story are responsible for managing high risk, high reward portfolios. To place your money with the hedge funds listed above, you must qualify as an accredited investor. To do so, your net worth needs to be above $1 million and you need to make over $200K a year.

However, don’t get so swept up in the situation that you forget – this war is deeply impacting people who own multiple boats.

Is GameStop the next Blockbuster?

In the story of GameStop, hedge funds borrowed money from brokerages to place a bet that GameStop would fail.

Once the vultures started circling, a press parade was released to create optics that GameStop was the next BlockBuster, even though on paper the situation is nothing alike.

— Ryan Cohen (@ryancohen) January 6, 2021

Blockbuster was actually bloated with debt before Netflix even came along, and facing fierce competition from Hollywood video.

I know this because in 2006, I wrote a paper about why Netflix would put Blockbuster out of business. My professor gave me a B with a note that said ‘Good paper but this would never happen,’. I didn’t know how to buy stocks at the time, but I probably should have dropped out of college and learned.

So, no one is more interested than I am in figuring out which industry technology is going to disrupt and upend next. But it isn’t gaming…yet.

Why the gaming industry will take longer to be disrupted by streaming than movies and television:

The Internet Provider Monopoly

Game files are much larger than movie or music files.

Unlike movies and music, video games require extremely high-speed Internet. Internet speed in the United States is throttled by an Internet provider monopoly and a copper wiring infrastructure which isn’t soon to be replaced with fiber optic lines.

The quality and realism of video games has advanced at a rapid pace over the years. Video game files are extremely large, which means you can easily hit your data cap if you attempt to download or stream a game.

The Billionaire Activist Investor

I prefer not to bet on companies by examining their executive suite. But, it is important to acknowledge Ryan Cohen’s track record:

- Built Pet eCommerce brand Chewy and sold to PetSmart for $3.35 billion in 2017

- Largest individual owner of Apple Stock shares

- Invested about $76 million to buy more than 9 million shares of GameStop, which spiked to around ~2.9 billion during the $GME rise.

- Still owns his shares and investment in the company and clearly is not in this for a short squeeze

2021 Opened to a New Console Cycle

Before anyone was discussing stock wars, the news of December of 2020 was console wars between Microsoft and Sony.

The video game industry is healthier than ever, with 2021 opening with a competitive console cycle for XBox Series X and PlayStation 5.

Every console cycle incurs a wave of purchases made around games, accessories, and of course the consoles themselves. And it is no secret gaming popularity has reached an all time high in popularity during shelter in place.

Weak Competition, Strong Opportunity

GameStop is the only retailer ubiquitous for gaming. The opportunities for eCommerce in this space are endless and exciting, and GameStop is well positioned to seize them.

THE SAGA – A Timeline of Events

June 7, 2019: RoaringKitty / DeepF$ckingValue posts his GameStop position, and reasoning behind why the company could be a viable deep value investment.

April 2020 – Michael Burry, famously known for his billion-dollar bet on the 2008 US housing-market crash as documented in ‘The Big Short’, purchases GameStop shares.

August 31 2020 – Ryan Cohen purchases 9,001,000 shares of the company (speculatively a numerical Dragon Ball Z meme reference).

Fall 2020 – Burry exits a majority of his position in $GME, leaving his current ownership of the shares unknown.

November 16, 2020 – Cohen writes a letter to board of directors urging change and predicting opportunity.

January 1, 2021– GameStop begins the year as one of the most shorted companies on the market.

1/ 11 / 2021– Ryan Cohen joins the GameStop board and brings Chewy Alumni Alan Attal and Jim Grube. $GME shares hover around $19.94.

1/ 27 / 2021 – $GME begins doubling in price, finally rocketing to an all time high of $347.51 a share.

Shorts lose a record of $5 billion betting against GameStop.

Mark Cuban tweets support of r/WallStreetBets

I got to say I LOVE LOVE what is going on with #wallstreetbets. All of those years of High Frequency Traders front running retail traders,now speed and density of information and retail trading is giving the little guy an edge. Even my 11 yr old traded w them and made $

— Mark Cuban (@mcuban) January 28, 2021

1/ 28/ 2021 – Brokerages including Schwab, TD Ameritrade, ETRADE, and Robinhood remove ‘Buy’ button, blocking purchases of $GME $AMC $BBBY $NOK under guise of ‘protecting’ retail investors.

$GME’s stock drops to $193.60 a share. An S.E.C. investigation is urged.

$187 million shares of $GME are purchased During the trading pause. Clearly, not by the retail investor blocked from making transactions that day.

Hedge funds are still allowed to trade and therefore use the opportunity to escape their short sell position.

Angry billionaire Leon Cooperman takes to CNBC to complain about how poor people gang up on the rich, and how people are cashing in their unemployment checks to purchase stocks.

Listen to this incredible crybaby pic.twitter.com/KmJvZpBQ59

— Timothy Burke (@bubbaprog) January 28, 2021

1/29/ 2021 – Purchasing of suppressed retail stocks is made available in limited capacity by some brokerages, and $GME soars again.

WSB Redditors find ways to donate earnings to charity and give back, including college student Hunter Kahn who purchased several Nintendo Switches to donate to a Children’s hospital.

View this post on Instagram

- Melvin Capital takes a 30% haircut of its 12.5 billion value, but is bailed out by Citadel and Point72.

- Robinhood is hit with a class action lawsuit.

- Short-sellers lose $19.75 billion on GameStop in January alone.

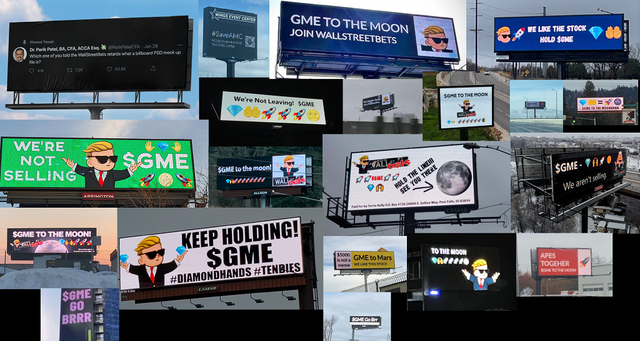

1/ 30/ 2021 – Supporters purchase billboards and even plane flags as a show of support and camaraderie.

Appearances have been seen across the United States from Oklahoma, to Austin and Santa Monica Most notable and infamous is the billboard in Times Square.

The Today Show reports a fifth grader’s Christmas gift of $60 in $GME stock skyrockets to $3000

February 1, 2021 – Netflix and the Winklevoss twins plot a movie about the whole saga. If you don’t know who the Winklevoss twins are, be sure to watch The Social Network.

2/2/2021 – Mark Cuban hosts a Reddit AMA on R/WallStreetBets to educate and advise retail investors as $GME plunges back to earth.

If you need to get caught up on my story, you can watch this video of my husband and I’s experience as GameStop investors, or listen in:

Yes – we knew $GME would lead to a crazy short squeeze. But we also saw GameStop’s potential as a deep value investment, something the greatest investors of our time would approve of. Warren Buffet himself considers himself a value investor.

What we didn’t know is that $GME would become the symbol of a revolution, and choosing to hold in our investment would be the ultimate act of rebellion.

For the first time in a while, Democrats, Republicans, and the People seem to have united in agreement that this episode finally proves (again) that the ‘free market’ is actually rigged.

No matter which side you chose, it’s hard to deny the fascinating tale of the power of unity told by GameStop’s meteoric rise from the tomb.

Before we dig in, please click here to read this VERY important note about how to approach high risk investing if you are thinking of trying this at home.

What’s Next?

Now that the short squeeze has “squoze”, GameStop released a press announcement that it is bringing in an A-List team, including a CTO from Amazon and a Customer Care VP.

Value investors wait for the movie release and the long game to play out.

What did we learn?

1. Follow mainstream news at your own risk.

I always suspected WallStreet owned the news, and used it to create cycles of fear and greed. This week, my suspicions have been more than confirmed. Even some of my favorite counter-culture financial bloggers really dropped the ball on covering this story in full accuracy.

Why does Wall Street have such an advantage over the little guy?The SEC. SEC doesn’t follow laws.They have legal precedents. Which means they can sue you knowing you have no financial ability to fight back. As can Wall St. SEC protects no one but the jobs of their own lawyers

— Mark Cuban (@mcuban) January 30, 2021

2. America’s money game is still rigged.

So rigged that the people behind it have no issue snubbing laws in public view just to swing things back in their favor.

Like 2008, politicians will make a kerfuffle and drag some people into court to get votes. An innocent underling will be sacrificed to take the fall for the sins of the many. And nothing will change.

Or maybe not! Maybe I’m wrong. I sure hope so. Either way, I hope a good movie comes out of it.

All I know is, the game didn’t stop, and I’m staying in it.

Who do you think won the $GME war? Comment below and tell me all about it!

If you want to get into the game yourself, you can use this link to sign up for Robinhood and get some free stock.

Full disclaimer: I will get some free stock if you sign up as well, which means I will get a $5 reward for the 20 hours of free work I put into writing this!

Everything You Ever Wanted To Know About GameStop Stock’s Saga, but Were Afraid to Ask

THE GAME

? ? Value Investing: Purchasing shares of stock from companies with intrinsic value at a fair (or undervalued) price.

Deep Value Investing: Purchasing multiple depressed companies at a cheap price, with the knowledge that eventually the price will rebound to the mean.

Activist Investor: An investor who looks for deep value opportunities.

Float: The amount of regular stock shares a company has issued to the public that are available for investors to trade.

? ? Options Trading: An extremely volatile and high risk form of investing in which you purchase a contract and put down a deposit that gives you the right to buy or sell an asset at a fixed price for a specific period of time.

Short Sell: Betting a stock will fail, and borrowing money to make that bet. An investment or trading strategy that speculates on the decline in a stock or other security’s price.

Squeeze: When rapid price movements in a company’s stock force investors to make changes in their investment positions that they otherwise wouldn’t.

Short Squeeze: When a rising stock price forces people who had sold the stock short to buy back those shares, driving stock prices higher.

YOLO: a millennial slang term ‘You Only Live Once’ that has now become a rally cry for taking a risky gambling move with a stock.

Stonks: A meme term created to poke fun at an investment loss or amateur financial move.

Gains or Gainz: Stock price increases or earnings you make on an investment when you sell.

Buy the Dips (not the Rips): Buy low, sell high.

Loss: The amount you lose when you sell an investment or stock that has underperformed.

r/WallStreetBets: or WSB for short, is a subreddit where participants discuss stock and option trading. The forum participants use these self-deprecating terms to mock themselves and each other.

- ? ? Diamond Hands – the nerves to hold an investment position long term

- ? ? Paper Hands or Toilet Paper Hands – the tendency to sell at the slightest market movement

- ? ? ‘To the Moon’ or ‘To the Stars’ – riding an investment to high profit, despite volatility

- ? ? Tendies – an abbreviation of chicken tenders meant to refer to money or profit

- ? Loss Porn – screenshots of investment losses

- Brrrrr – a reference to the sound a money machine makes

- Austists – an investor who does due diligence

- Degenerates – an investor who mostly gambles

- Retards – a completely novice investor

Capital Gains Tax: The tax you pay on a stock you sell after holding it for a year. If you wait to sell a stock for a year, you will pay this tax on your earnings.

Income Tax: The tax you pay on how much you have earned in a year. If you sell a stock in under a year, this is the tax you will pay on it.

THE PLAYERS

GameStop: A popular video game retailer started in the 80’s, known for trading and selling video games, gaming merch, and consumer electronics.

Reddit: An online forum in which communities gather anonymously to discuss niche interests. Think of it like an anonymous Facebook, that has only groups and no status updates or photo albums.

Retail Investor: A non-professional investor who buys and sells securities or funds that contain a basket of securities such as mutual funds and exchange traded funds (ETFs).

RoaringKitty: Also known as DeepF*ckingValue on Reddit, the former Massachusetts financial adviser and once anonymous YouTuber who predicted GameStop’s survival, and defended his logic behind for months despite an uproar of doubt. RoaringKitty bet $53k on $GME in September 2019, and the position is now worth ~$48m.

Michael Burry – The investor who profited from predicting the collapse of 2008, who also purchased multiple shares of $GME in late 2019.

Ryan Cohen: The eCommerce Founder sold his pet e-commerce company Chewy to PetSmart in 2017 for $3.35 billion. Cohen now sits on the board of GameStop, and owns 12.9% of the company.

WallStreet: An 8-block strip in Manhattan and home to the New York Stock Exchange and NASDAQ, now WallStreet is a collective name for large financial and investment institutions.

Hedge fund: A limited partnership of investors that uses high risk methods, such as investing with borrowed money, in hopes of realizing large capital gains.

Hedge funds who bet on GameStop’s failure include D1 Capital, Melvin Capital, Citadel Securities, Citron Research, Omega Advisors, and Point72.

Brokerage firm: A platform that connects buyers and sellers to facilitate a transaction. Brokerages typically receive a small fee for implementing every transaction, or in Robinhood’s case, collect data as a business model. Examples of brokerages include Charles Schwab, TD Ameritrade, E*TRADE, Robinhood, and Fidelity, among many more.

Robinhood: A free online trading app once beloved by the Reddit trading community, especially for its occasional technology glitches that users attempted to exploit for gains.

Market Maker – Large institutions who supply liquidity to the market. There isn’t alway a person on the other ‘end’ of a buy and sell trade. Market Makers like Citadel supply the cash on the end of these transactions. These entities typically profit off of the ‘BID’ and ‘ASK’ spread.

Citadel Securities, owned by billionaire Ken Griffin, is a market maker and intermediary for Robinhood.

Clearinghouse: Intermediaries between buyers and sellers that guarantee the trades. Brokerage firms are defending their decision to suppress $GME purchases by citing that clearing houses became uncomfortable with the stock’s volatility.

The Securities and Exchange Commission (SEC) – a U.S. government agency that oversees securities transactions, financial professional activities, and mutual fund trading to prevent fraud and intentional deception.