Table of Contents

Are you wondering how to increase credit score? Or what a credit score even is? With the tips below, getting a great credit score can be fast, easy, and free.

Having a good credit score can save and make you a lot of money. Having great credit means you can get the lowest interest rate anytime you want to leverage your money in real estate, business, or life.

It also means you can get approved for fun credit card sign up bonuses – more on that below.

As the overachiever I am, I should love credit scores. A number to define my progress as an adult? Hello, validation!

But the f*cking truth is that, like grades in middle school and SAT scores, I find credit scores arbitrary and stupid.

Why?

The credit card score is filled with nonsensical contradictions.

For example:

- You need a credit score to get a credit card. But you need a credit card to get a credit score.

- You’re rewarded for taking on more lines of credit….but then you’re penalized for opening up too many lines of credit too fast, because it shows as a hard inquiry.

- Credit scores neglect tons of important information, like on time rental payments.

- Your credit score rewards you for taking loans you don’t need.

- Younger people are flat out punished simply for their lack of time on the planet.

You see why I think this is all insane.

In what world does it make sense to put a mark on someone’s credit for closing a ten year old card you don’t use anymore? Or for getting a background check from a prospective employer?

The credit score game is also run by three privatized bureaus, Equifax, Transunion, and Experian. These agencies gather data, and then develop their own, secretive algorithms to predict how likely you are to re-pay a loan.

All three of them have been busted for some shady practices and questionable decisions over the years. I’ll let the headlines speak for themselves:

By the way, if you have ever used Equifax for a credit score report, be sure to check to see if you qualify for settlement money.

Which is why this whole system kinda pisses me off.

I’m not alone on this. There is already a proposal to overhaul this confusing and mysterious system. But that dream won’t come to fruition for another decade.

So, in the mean time there is goods news is: If you know the credit rules it is pretty easy to win.

Learning the credit score game can ultimately save you hefty amounts of bread over your lifetime. So let’s figure out how to game this system.

Here is where most bloggers might recommend you go get a free credit report from Experian, Equifax, or Transunion.

Seriously – screw that!

I made that mistake in my twenties. You might have noticed, these three credit bureaus are a hot mess. I can barely keep track of the data leaks and lawsuits. All of them are privatized companies who have way too much information about us, and make a profit by selling it.

Because of Equifax’s abysmal security, I’m pretty sure my personal information was hacked and leaked all over the dark web somewhere.

Instead, my suggestion is to get your credit score by signing up for Credit Karma, Credit Sesame, or on Mint.com. Once you know what your score is, let’s figure out how to boost it.

What are the 5 factors that determine your credit score?

How credit score is calculated:

- On-time payment history: 35%

- Credit usage: 30%

- Credit age: 15%

- Total credit lines, a.k.a. account mix: 10%

- Hard credit inquiries: 10%

How to Increase Credit Score Fast

1. Pay all of your debt in full and on time

This is the most important rule, because on time payments account for 35% of your credit score.

Pay in full on the due date and don’t keep a balance. I repeat, never miss a payment.

Here’s how this part of your credit score is calculated:

On time payments / total payments = % of paid on time.

This calculation should be above 99% to be in the good range. That means for every late payment, you need to make 99 on time payments to find your way back to an excellent score.

2. Start your credit history ASAP

The longer you have your lines of credit open, the better your credit score.

That means, I was ultimately punished for waiting until I was a wise and informed adult to open a credit card.

When I decided it was time to divorce Wells Fargo and Bank Of America (more on that someday about why you should too), my score was punished for closing the single Wells Fargo credit card I never used and couldn’t even remember signing up for.

Here is where we really enter arbitrary land.

Your credit history is the average age of your credit. So even if you have had a credit card for ten years but recently opened a new card, your score will likely drop because the average of your credit is now five years.

Insane? Yes. But let’s keep going.

To ensure you have a solid credit history, sign up for a zero fee credit card you don’t mind having on hand for the rest of your life, and will have reason to occasionally use.

You have to use this credit card every once and while to make sure it doesn’t get closed on you, and accidentally destroy your credit history in the process.

The one I use is the Amazon prime 5% cash back. I try to avoid Amazon and support local businesses, but I still have to use it sometimes. Which brings me to…

3. Buy everything with credit cards (but only if you can immediately pay it off)

Whoever told you not to use credit cards is probably…giving you some really sound and wise advice, actually. If you have any consumer debt, please pause here and read this blog on how to conquer that mountain real quick.

Done? Great. Back to the show.

Once you have a solid cash cushion of 3-6 months of savings, you can use it to pay off your credit card bill and then some. Not to mention, you will get to enjoy the fun perks of credit card points.

Quick aside:

In college I naively signed up for one of those GAP cards to get a discount on a jacket. A month later, a traumatizing bill arrived featuring interest charges and late penalties that far exceeded the original card signup “discount”. And it kind of wrecked my non-existent credit.

Ever since, I was afraid to touch a credit card with a ten foot pole. I suspected debt was evil, now this belief was solidified by first hand experience.

This is a good thing. I am glad I waited until I was more mature and self actualized for my second attempt at this rodeo.

Someday I will also explain the myth of ‘good’ versus ‘bad’ debt and why there is no such thing as either, but I digress.

4. Set up automatic credit card payments

This tip is pretty much the secret to all my success in life.

As you now know, on time, in full payments account for 35% of your credit score, and a late payment takes seven years to disappear from your credit score.

Yikes! The good news is, late payments aren’t reported unless they are over 30 days late.

For my next credit card attempt, I was PRE-PARED my friends. After reading several personal finance books back to front, I was ready.

I was even ultra careful (paranoid?) about which credit card I signed up for (SGP American Express, I love and miss you). The exact moment the card was open, I set up automatic payments from my bank account.

Thanks to buying everything with that credit card (which then was automagically paid off), I was able to stay in world class 5 star resorts for years, FOR FREE!

Here are some of my favorite highlights. In case you were wondering how I afford my Instagram lifestyle, now you know.

View this post on Instagram

View this post on Instagram

View this post on Instagram

View this post on Instagram

I’m not sure if I have ever actually made a manual credit card payment. That is how insanely automated my finances are.

5. Call your credit card company and request credit limit increases

Another method to the madness is “credit utilization”, or the total amount of debt divided by total credit available. To achieve the best score here, you want to keep this number under 30%.

What does that jibber jabber mean? You get a better score if you have lots of credit available to you, but you don’t use it.

Yeah, I don’t get it either. They want you to have credit but not use it. Whatever.

Anyway, let’s say you have a credit limit of $10,000, and a monthly credit card bill of $5000. That means you are using 50% of your credit monthly. Not ideal.

That is why you want to call your company and try to get a credit limit increase to at least $15,000 (or much higher) so that you aren’t using more than 30% of your available credit.

6. Open up multiple lines of credit

Signing up for multiple cards will also increase your overall credit. Having more than 11 lines of credit puts you in good standing. Over 21 lines of credit puts you in excellent territory.

7. But don’t open too many different lines of credit at a time

Applying for a credit card hits the score twice because of the hard inquiry it opens, and the reduction of the average of your credit history.

The good news is, this is temporary. A credit check only impacts your credit score for twelve months, and drops off of your credit report after two years as thought it never existed.

Applying for several new credit cards, shopping for a mortgage, and financing a car all within the same timeframe raises red flags. So, take these adulting moments one at a time, preferably spaced out by six months at least.

By the way, I recently learned that the same type of inquiry can count as one, if it takes place over a short period of time. For example, if you receive multiple inquiries for a housing background check, it will only count as one credit inquiry. That is why you should consider signing up for multiple credit cards at once if you need to bulk up your lines of credit.

After you master this, I will teach you how to churn credit cards to travel for free, young grass hopper. However, like investing in GameStop, this is an advanced topic, so please make sure you have mastered these basics first.

8. Credit piggybacking

Aside from requesting credit limit increases from you bank, here is another hot tip I love to increase your credit score fast.

If you have a close friend or family member with excellent credit, you can request that they open up a credit card for you in their name. For example, if I open up a Chase Sapphire Preferred and then request an extra card in my husband’s name, it will boost his credit score by counting as a new line of credit. However, no inquiry will be made on either of our accounts, because the card is already open.

Word on the personal finance streets is banks are onto this, and frown upon it. So take advantage while it lasts.

What are the 5 levels of credit scores?

Credit score chart:

- 750 – 850: Excellent

- 700 – 749: Good

- 660 – 699: Average

- 580 – 659: Poor

- 300 – 579: Worst

Credit score scale:

-

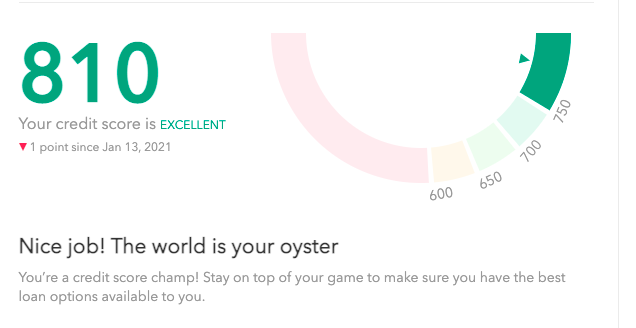

Credit score 800

An 800 credit score is considered excellent.

-

Credit score 700

Is a credit score of 700 good?

Yes! It is right on the cusp of having solid credit that will benefit you long term when applying for a loan.

-

Credit score 600

Is a credit score of 600 good? Not really. The good news is, it could be way worse. Follow my tips above, and you should be well on your way to a better credit score.

What is the Credit score average?

The average credit score in the United States according to Experian research is 711.

According to Experian, the average credit score of a 30 year old is 634 which isn’t great.

Credit score average by age

Generation Z (18-23) 674

Millennials (24-39) 680

Generation X (40-55) 699

Baby boomers (56-74) 736

Great generation (75+) 758

Interesting fact: the overall population average experienced a credit score increase over the year 2021, except for Generation X. As you can see, your credit score is likely to improve with age, likely because your credit history is longer.

What is the best Credit score when buying a house?

You can get a mortgage with a credit score as low as 620. The ideal credit score to buy a house is 740 or higher to receive the lowest possible interest rates on a loan.

The higher your credit score is, the less interest you will pay on a loan for a mortgage or car payment.

What is considered a good credit score in 2021?

Anything over 700 is in a desirable credit range.

Which credit score is best?

850 is the highest possible credit score you can achieve.

If you ever meet a rare and mysterious unicorn with this high of a credit score, please contact me immediately so I can have them on the podcast.

Is it possible to get a 850 credit score?

Allegedly this is possible, but at this point, you are just showing off.

What is your favorite trick or tip to boost your credit score? Share it in the comments below ?

Comments are closed.