Table of Contents

Are you wondering how to invest in stocks for beginners with little money?

Perfect. Because today, we are going to reveal the one, very important thing you might NOT be doing – that could cost you a million bucks.

Spoiler alert: The worst financial decision you can make is not indulging in creamy, creamy, avocado toast and Starbucks lattes.

So what is the one thing that will cost (or make) you millions of dollars over your lifetime?

The answer might surprise you…

Investing in index funds, also known as broad market ETFs.

I also saw the Boomers crash and burn in the stock market in ’08 and it scared me. I thought it was practical to heed warnings that stocks are a ‘scam’ and a ‘losing game’.

Like a grandma, I decided to stuff my savings into the digital equivalent of a mattress – a.k.a a low interest saving account. I thought I was being smart and playing it safe. But because of inflation, I was actually losing money.

I did everything I was taught: Side hustled. Saved. Negotiated my salary up every year.

Enter my crisis on the corporate treadmill. Every time a finagled a raise, most of it went to taxes. I was left with added work, stress, and responsibilities without an actual pay increase.

Then I started doing the math. I realized the brass rings in life I was grasping for – kids, a wedding, a house – were impossible to reach without getting into massive amounts of debt and squelching the hard earned nest egg I was white knuckling.

None of this hard work was actually working. Trying to traverse the middle class ocean to the next level felt like an impossible game. After a decade of diligently saving 25-50% of my income I felt lost and burned out.

To say I became disillusioned is an understatement. All the while cursing late stage capitalism and the false promises of the American dream I so naively bought into. It was a self sabotage sight to behold. A voluntary rock bottom, if you will.

And, it was the best thing that ever happened to me.

During this time, I started to question everything I believed in and was taught about money, business, and success.

If hard work doesn’t = money, what dose?

I’m glad you asked:

Strategy.

It was only after burning the brambles of what I thought I knew about success that I could open my mind to a strategy that would quadruple my net worth in just a few short years.

Around this time, I learned some new things that caused me to flip my recipe for success:

And it doesn’t involve getting your invention on Shark Tank OR flipping houses!

- 80% strategic decision making + mindset

- 20% hard work + saving

Here is the ‘explain it like I’m five‘ investment strategy I discovered that could make you a millionaire way quicker than you think possible.

How to Invest in Stocks for Beginners with Little Money

-

Buy index funds.

-

Don’t sell them

-

Repeat

-

The end

Okay, okay. It is a sliver more complicated than that. Let’s dive deeper.

Or, scroll to the bottom if you’re already sold and want to find out step by step instructions on how to implement this playbook right now.

What is an Index Fund?

An index fund is the most intelligent ‘stock’ you can buy is designed to mimic performance of a financial market index. Instead of being one ‘stock’ it is more like a compilation of greatest hits.

Instead of attempting to ‘beat’ the market, broad market ETFs are devised to mirror it.

For example, in a year like 2020, oil stocks go down and tech stocks go up.

You win either way, because with an index fund you own both of those stocks. If next year oil is up and tech is down, you win again!

Because you own a piece of the entire market.

The coolest thing about index funds is how they create an infinite wealth loop – thanks to the magic of compounding interest.

But, we’ll save the math and magic of compounding for another day.

A Quick History of Index Fund Investing

Index Funds were invented by industry legend Jack Bogle in 1975, after being conceived by investor Benjamin Graham a decade before.

At their inception, Index Funds were wildly unpopular.

Bogle found inspiration to push this innovative (and scandalous) brain child to life through mentor and MIT economist Paul A. Samuelson. Samuelson was not afraid to call B.S. on the fallible belief it was possible to ‘predict’ or ‘outperform’ the market:

“A respect for evidence compels me to incline toward the hypothesis that most portfolio managers should go out of business – take up plumbing, teach Greek, or help produce the annual GNP by serving as corporate executives.” – Prof. Samuelson, Challenge to Judgment

Titled ‘Bogle’s Folly‘, Index Funds under-performed at first in the sluggish 80’s market, and took about a decade to catch on at all.

It makes sense that this strategy was ridiculed as ‘mediocre’ and ‘Un-American’. The idea that an algorithm could outperform human expertise was an affront to the Wall Street ego.

This new kid on the block also posed a serious threat to the high fees that make financial advisors wealthy.

If a statue is ever erected to honor the person who has done the most for American investors, the hands-down choice should be Jack Bogle.

– Warren Buffett

Fast forward to 2020, and Index Funds are more profitable than 85% of actively managed funds. Instead of incurring the high fees of actively managed mutual funds, index funds are a passive strategy.

Index funds not only cut out 90% of fees, but democratized investing to make it accessible to the greater public.

What about stocks? Aren’t they risky?

YES.

The key to the stock market is to steer clear of individual stocks. No one can truly ever know how a single stock will perform – not even CEOs of the companies themselves.

In fact, the C-Suite is doing everything they can to make their stock look hot, even if it is tanking.

What is the difference between Index Funds and Stocks?

Buying individual stocks is akin to playing slots at a casino. Enjoy it from time to time over a cheap beer and hot dog, but know full well that the house is rigged to win.

In comparison, Index Funds are like owning a piece of all of the slot machines, and some of the casino itself.

A word of warning:

Index funds can be a gateway drug into dabbling in individual stocks. I hobnob with a lot of ‘stonk heads’.

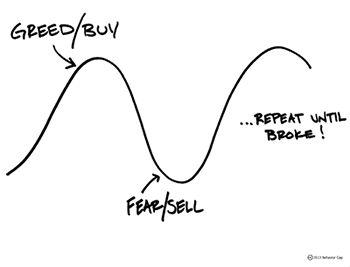

Despite being financially brilliant and knowing all there is about long term investing, these junkies are addicted to the adrenaline of ‘buy, sell, buy, sell’.

You will often hear them loudly and ostentatiously bragging about their ‘20,000 dollar day!’ but they always conveniently omit the part when they lost $40,000 dollars yesterday.

If you run into one of these types, be sure to challenge them with the question: “How much are you up overall?”

You might have to repeat several times until they actually do the math and allow cold, hard reality to set it.

Stock addiction aside, the most damaging risk you can take, is not taking any risk at all.

Learn from my mistakes.

Shouldn’t I be allocating among mutual funds and bonds?

Mutual funds and bonds are for the weak. Kidding. (Kind of.)

The truth is, bonds and mutual funds are better to seek out nearing retirement, when you might be looking to draw down on your nest egg. Even then, this ‘safety net’ doesn’t always work out. For example, bonds didn’t do so hot in the 2020 market dip.

You do you, but I personally plan on aggressively staying in index funds until I retire and beyond. Scroll to the bottom of this post to to find out a portfolio allocation for pre-retirement, and post-retirement.

What about emergencies?

Wait until you have built solid ‘F.U. Fund’ groundwork before going ‘all in’ on index fund investments. That means, saving 3-6 months of living expenses in cash reserves.

That way, if something like say…a worldwide pandemic hits and millions of people are laid off – you are still covered. You can live off this reserve while your index funds keep doing their sweet, sweet thang.

So long as you DON’T SELL, the only other way you can lose on an index fund is if the entire US or first world economy tanks.

If that happens, then we will all have plenty more to worry about than tracking index funds – like hoarding water supplies and bullets.

This is where I should add that this ‘worst case scenario’ did happen to Japan’s economy in the 80’s. The property and share bubble burst, and the country entered a twenty year long recession.

I am not going to claim this is out of the realm of possibility. Everything is possible.

Lost decades happen. During the terrorist attack and recession of 2001-2009, the stock market averaged negative gains of 2%. However, the decade before that, it returned 18%.

That equals an average of – guess what? 8%.

Also consider that smaller countries (and markets) have less industry (diversification) and therefore are more vulnerable to collapse.

If you are super risk averse, diversification is your best friend.

Instead of investing in the U.S. market only, you want to stick with a mix of index funds across first world markets – the United States, Canada, Australia, etc.

Make a backup plan to invest in real estate. In case the economy bottoms out, at least you’ll have somewhere to live.

What happens if the stock market drops and I lose all my money?

I have news for you. Stocks will go down, but here is where the most important part comes in:

You don’t lose until you sell.

Here is where the women are separated from girls when it comes to investing:

Your index funds will sky rocket and dip. They will go up and down. This is natural and normal.

If you want to understand why, watch this quick 30 minute video on economics from bajillionaire Ray Dalio:

That is why you must grow a steel pair of cajones (or ovaries) and buckle in for the ride.

Or better yet, buy more.

A drop in the market is basically like a stock sale. For me, a stock market crash is the finance nerd equivalent of a bargain basement Prada sample sale.

I awoke on the crash of 2020 like a little kid on Christmas morning. Finally, the moment I had been waiting for! I couldn’t wait to dive head first. It was a free for all index fund shopping spree.

The most important thing:

“Be greedy when others are fearful, and Fearful when others are greedy,” – Warren Buffett

Ignore the drama of talking heads like Kramer bashing and hyping stocks, or that random bartender telling you to buy bitcoin. For your investing strategy to be successful, you cannot buy into mass hype.

See the big picture and think long-term.

Index funds are especially beautiful because they reward laziness and simplicity. My two most endearing traits 😉

When everyone started telling me to buy bitcoin, guess what I did?

What I do best: Nothing.

I thank my rebellious, contrarian nature. Also I couldn’t figure out the Coinbase app. And that is a good thing, because I would have purchased bitcoin at the height of the bubble, right before it crashed again. I did eventually snap up some Bitcoin, when no one cared for a minute.

Learn to surf the waves. Or simply automate and forget to look at your portfolio for years on end.

Here’s how:

Set It, and Forget It

To arm yourself with zen-like indifference to your money, look to automation.

The perfect ‘portfolio neglect’ path to riches is ‘set it and forget it’. Set up an automatic 10-50% deposit from your paycheck or checking to purchase index funds.

Side note: In an enthralling future post, I will outline how to allocate your paycheck into budget and savings buckets – stay tuned.

Is it good time to buy and invest in stocks?

If you mean Index Funds, then yes. The best (and only) way to ‘time the market’, is to start today.

When it comes to timing, don’t ask ‘When?’ but ‘How long?’

This is where I should bring up ‘dollar cost averaging’ – an overly complicated human invention to mitigate feelings of risk.

Dollar cost averaging (DCA) is the practice of spacing out your investment over months. Instead of putting $100 all in now, you invest $10 every month for ten months.

As a high anxiety gal who loves to play it safe, I am totally guilty of doing this, despite my logical brain knowing better.

The theory is, some months the market will be low, others it will be high, and therefore you will reap the average of the two.

It is a strategy to ‘circumvent’ buying high when the market is about to crash. One one hand, it might help you reduce emotions and anxiety around investing, which is a good thing. Manage your mindset before you manage your money.

And yes, technically it may protect you from bad timing. But only if you plan on selling your investment short term. Timing doesn’t matter so long as you have a 10-30 year plan to stay in the game.

The disadvantages to DCA, is that the market tends to rise over time.

My wealthiest friends today are the ones who ‘went all in’ on real estate and stocks in 2007, and road the bull all the way through, without panicking and abandoning ship.

Investing a portion of your income every month is ‘DCA’ by default. So there is no need to build this into your strategy.

Trying to time the market can throw you into analysis paralysis, and keep you from getting started.

How long you stay in the ring is what matters.

The only way to prevent ‘shoulda, coulda, woulda’ is to just get in the game. Just start now.

Can I touch it?

No. Consider everything you invest in an index fund to be gone forever until you retire. Which you might be able to do in less than a decade if you follow this strategy.

A lot of people struggle with this. Overachievers especially feel the need to micromanage their money by moving it around.

Why?

The human brain feels the pain of loss more than the joy of winning. Constantly obsessing over the slight ups and downs of the market triggers ‘myopic loss aversion’ which will cause you to panic and sell during downturns, and buy on upswings.

Selling at a gain might feel fun, but you are only cheating your future self. Don’t rely on an emotional human brain to outsmart the magical algorithm and equations of diversification.

Also, anytime you sell, you will need to pay taxes on your gains.

Pro tip: don’t do this.

Getting rich by doing nothing? Yes. We. Can.

This is where I really shine. If you are indecisive, hate micromanagement, or can’t stand betting on the wrong horse, this is a fantasy come true.

You can pick all the things! You can be right on every stock you bet on because you are betting on them all!!

So when can I take my money out?

The average stock market return is 7%. That does not means your index fund investment should grow 7% on average every year.

Some years you might get a 20% return. Some years you might see a 20% drop. The more years you keep your cash in investments, the more you will benefit from the average of ‘7%’.

Where does 7% come from?

Billionaire investor, Warren Buffett:

“The economy, as measured by gross domestic product, can be expected to grow at an annual rate of about 3 percent over the long term, and inflation of 2 percent would push nominal GDP growth to 5 percent, Buffett said. Stocks will probably rise at about that rate and dividend payments will boost total returns to 6 percent to 7 percent, he said.”

While 7% is a safe projection, actual recent returns to date are 10% according to NerdWallet.

When you do decide to start living on your investments, assuming a moderate 4% withdrawal will ensure your portfolio continues to spiral on an infinite loop of wealth by reinvesting 3%.

That means, if you can live on 45k a year, all you need to retire forever is a million dollars in the bank.

If you can live on 25K – your magic number is 500K.

If this sounds crazy to you, it is because it is. Crazy amazing.

Playing it Safe with Bonds and Mutual Funds?

Are bonds and mutual funds really the answer for those of us who are risk averse? The data below will surprise you.

I have included a few investment allocation strategies from some of the most well known financial authors of our time.

The portfolio allocations are listed in order of who has experienced the highest rate of returns in the last decade.

The simplest and most profitable asset allocation was from JL Collins (100% stocks). It was also the second least volatile. Mr. Money Mustache’s asset allocation of 90% stocks and 10% bonds performed second best and was the least volatile.

We don’t want to make the mistake of assuming the past will predict the future, but we might want to look at these data points as evidence that bonds and mutual funds aren’t as ‘safe’ as we might assume.

The lesson is, no guts, no glory. But, thanks to strategy, you might be able to spare your stomach a few somersaults while getting rich, the savvy, practical, and patient way.

TL;DR:

What should a beginner invest in?

Index funds, because that is actually what the pros do. Anything else is just gambling.

How do I invest wisely?

Diversify your investments across U.S. and international. For the risk averse, keep a cash cushion and consider investing in real estate for further diversification.

How can I double my money?

Index funds.

How can I invest $1000?

Sign up for an account with Schwab, Vanguard, or TD Ameritrade. Click ‘Buy stocks’ to purchase just a couple of shares. Scroll down to the bottom of the post for symbol references, and step by step instructions.

Now, let’s recap how you can apply all of this advice right now.

How do I start investing with little money?

You can start investing today with as little as $100.

STEP 1: Sign up for a Charles Schwab (my favorite) account right here. You get $100 for signing up with this link and I get NOTHING. You are welcome.

STEP 2: Sign up for Personal Capital so you can start coveting your growing pile of coins like Scrooge McDuck. We both get 25 bucks if you click here and sign up with my referral link.

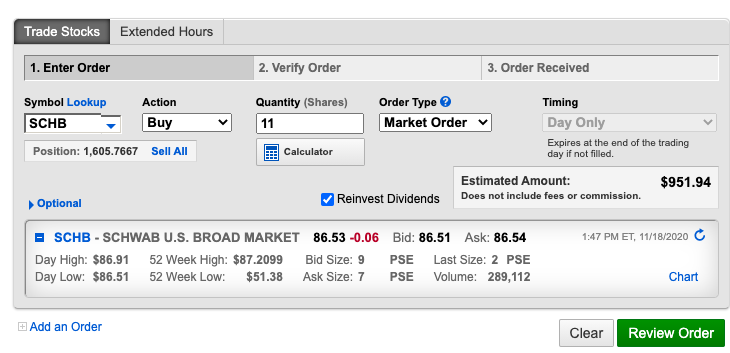

STEP 3: Once you’ve deposited some cash into your Schwab account, login to click ‘Trade’ on the top menu, and then click ‘Trade Stocks’.

STEP 4: Enter your symbol, action, quantity, and order type.

I chose ‘SCHB’, select ‘Buy’ and then calculate how many shares I want to buy that day with the calculator tool. I select ‘Market Order’ to buy stocks at the price they are currently at that day.

Or, you can place a ‘Limit’ order.

Sometimes, for fun, I place a ‘Limit’ to buy a certain amount of shares at a very low cost.

The order will only go through if the stock market starts to tank. It is an extra measure to make sure I am always buying ‘stocks on sale’. To chose my limit, I select the ’52 Week Low’ number at the bottom of the screenshot below.

These do expire after 90 days and rarely ever go through. If you are risk averse, this strategy can help you get and stay in the game, even if everything is going to hell and you can’t bear to look at the damage.

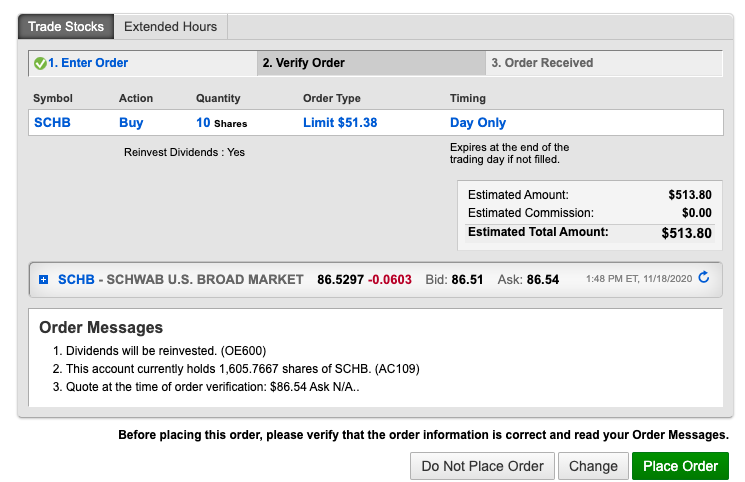

STEP 5: Review and Place Your Order.

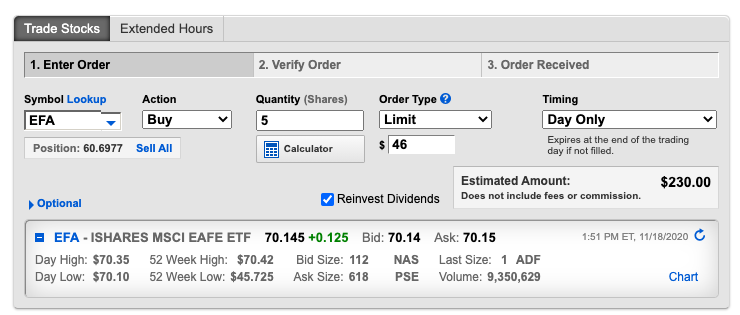

STEP 6: Repeat, with an International Index.

How you allocate your international verses US index investments is up to you. I have included various portfolio allocations at the end of this chapter if you would like inspiration. I aspire towards 80% US and 20% International.

The symbol for the fund I am currently investing in is:

STEP 7: Underpants!

Just kidding…It’s Profit!

Sit back, relax, and remember to come back and visit when you are retired ever after.

How the Pros Invest

As promised, here are a few various strategies for investing from my favorite experts. I found it interesting that the more complicated the strategy, the less profitable.

That being said, many of the experts below are already retired, and have moved into a less volatile phase of investing. Please note below that when I say ‘stocks’ I mean ‘Index Funds’ always.

JL Collins (and myself)

100% index funds.

Wins best performance.

A Simple Path to Wealth author JL Collins talks about two phases of life:

- Wealth Acquisition Phase

- Working towards retirement, and aggressively investing in 100% stocks.

- Working towards retirement, and aggressively investing in 100% stocks.

- Wealth Preservation Phase

- Living on your investments, with a less volatile allocation

- Living on your investments, with a less volatile allocation

For the curious, here is JL Collins wealth preservation allocation for after retirement:

Mr. Money Mustache

90% stocks /10% bonds

2nd best performance, least volatile

The Mad Fientist

- 90% stocks /10% bonds

- 72% US/28% International

2nd best performance, least volatile

Grant Sabatier, of Millennial Money

- 0.5% Cash (CASHX) – VMMXX: Vanguard Prime Money Market Fund

- 0.8% International Bonds (PFORX)- VWENX: Vanguard Wellington Fund Admiral Shares

- 2.2% US Bonds (VBTLX) –VWENX: Vanguard Wellington Fund Admiral Shares

- 25.8% International Stocks (VTIAX)

- VTIAX: Vanguard Total International Stock Index Fund Admiral Shares

- 60.2% US Stocks (VTSAX)

- 10.5% Alternatives (VNQ)

- VNQ: Vanguard REIT ETF

Root of Good

89% stocks – 50% International, 50% domestic

11% real estate (REITs)

- 11% US Large Cap (VLACX)

- 5% International REIT (WPS)

- 11% US Large Cap Value (VVIAX)

- 11% US Small Cap (NAESX)

- 10% International Small Cap (SCZ)

- 11% US Small Cap Value (VISVX)

- 6% US REIT (VGSIX)

- 20% Developed International (VTMGX)

- 5% Emerging Markets (VEMAX)

- 10% International Value (VTRIX)

Millennial Revolution and ‘Quit Like a Millionaire’ author

- 20% Developed Markets Stocks (VEA)

- 20% US Stocks (VTI)

- 40% US Bonds (BND)

- *20% Canadian Stocks (XIU.TO)

*Kristy is Canadian, and makes note of the tax advantages you receive by investing in your local stock market.

‘Couch Potato Portfolio’ from Scott Burns:

The ‘Lazy Portfolio’ from Allan Roth

- 40% Vanguard Total Bond Market Index (VBMFX)

- 40% Vanguard Total Stock Market Index (VTSMX)

- 20% Vanguard Total International Stock Index (VGTSX)

What is the best investment you have ever made? What is your experience with investing in the stock market as a beginner with little money?

Let us know in the comments below.