Table of Contents

‘How to Get Out of Debt Fast’ is Part 1 of our weekly series ‘7 Steps to Limitless Wealth’.

Jessica Robeson accomplished the phenomenal feat of abolishing nearly 38K of debt in just over a year on, wait for it…

…less than a teacher’s salary.

The best part? The blueprint she used to do it is repeatable. Are ready to defeat your own debt demons or just achieve big money goals? Keep reading to find out how Jessica did it, and how you can too.

In 2019, Jessica Robeson was living the dream.

Her career as a ‘hawk whisperer’ in residence was in full swing. She spent her days saving and caring for animals at the Lindsey Wildlife Center.

As icing on the cake, Jessica was preparing to marry the love of her life. She was also preparing to embark on a new career as an elementary school teacher shaping the generations of tomorrow.

But she had a looming weight on her mind. Before taking these big steps, Jessica had a secret she needed to confront.

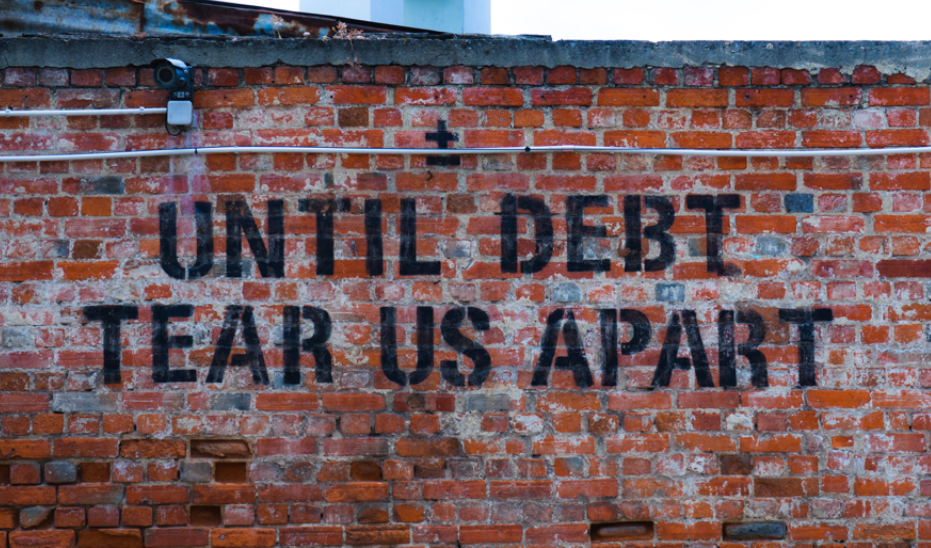

The big D. As in, debt.

Specifically to the tune of $37,000 in student loans, car payments, and miscellaneous credit cards.

Jessica wasn’t alone. In fact, she was slightly ahead. 80% of Americans have debt. The average American is saddled with about $38,000 of consumer debt, excluding mortgages.

Younger generations have a slightly lower average of $28,000 in debt, but the primary source will surprise you:

Credit Card Debt

Although most of us think ‘Millennial’ is synonymous with ‘student loan’, credit cards are the biggest burden for twenty and thirty somethings. Wage stagnation, combined with a soaring cost of living, has created an increased credit card dependency for younger generations.

Student Loan Debt

In Jessica’s case, her debt was broken down into about 25K towards student loans, 5K towards a car payment, and 5K in miscellaneous credit card debt.

With a dream of working with animals, Robeson diligently completed her degree in Ecology and Evolutionary Biology at UC Santa Cruz. No family support included.

While this dream was becoming an exciting reality, the price tag was a healthy amount of loans. Even after working to receive major financial aid and scholarships, Jessica entered adult life $25,000 of payments hanging over her head.

Like many of her time, the 2009 recession forced Robeson to defer student loan payments until she could find solid footing in her career.

Looking back, Jessica equates the defeating debt experience as akin to ‘flushing money down the toilet.’

Her day job at a nonprofit offered important, rewarding, and altruistic work. But the $15 an hour wages were barely enough to scrape by in California’s Bay Area, where the poverty line hovers at 83K a year.

No one could ever accuse Jessica of being lazy. To make it work, she did everything from house sitting to tending bar on the side.

Meanwhile, keeping up with student loans felt like struggling out of a quicksand pit. Every dollar earned was immediately blasted to oblivion by interest payments.

Attempts to escape became a confusing, slippery slope. Lacking a framework for financial success, it was tempting to get lost in seductive rumors of loan forgiveness, or worse, fraudulent schemes disguised as ‘business opportunities’.

Avoid These Debt Scams

Jessica even became a target. She encountered scam artists posing as a ‘student debt relief service‘ offering false promises of lower loan payments. The service offered no value in exchange for hefty fees.

Ready to do what it takes, she pounced on an ‘entrepreneurial’ side opportunity selling jewelry. After all, isn’t ‘hustle harder’ the solution to America’s larger cultural narrative?

That is when things took a turn from bad to worse. While on a sales pitch in San Francisco, her car was broken into. Her entire inventory of jewelry was stolen, leaving her on the line and with zero profit for her efforts.

Reflecting back, Jessica has a renewed clarity she became involved in a multilevel marketing scheme. She hopes her story serves as a warning tale. Thanks to her ambition, charisma, and gumption, she managed to come out on top, but wouldn’t wish the same traumatic experience on anyone.

More than anything, Jessica wished to enter the next stage of her life with a clean slate. Robeson was well aware money troubles can contribute to relationship strife.

Jessica was more than ready to build solid financial footing for her future and give her marriage every chance at lasting success.

And, it was while preparing to merge finances with her husband to be that Jessica finally stumbled upon a game changing solution:

Dave Ramsay’s infamous ‘Snowball Method’

This revelation armed Robeson with a plan of action. But she knew she couldn’t do it alone.

Jessica started by confiding in her fiance-to-be. She was surprised and relieved to find her transparency was met with support and an open mind.

Together they sketched out a plan for the future.

Now, Jessica was ready to break her silence and make another bold move: posting her debt free journey on social media. She hoped to inform her friends why she would be opting out of expensive social obligations for a minute.

Her bravery paid off. The support from her community was not only key to her accountability, but blazed a trail of inspiration for others in its wake.

This was only the beginning. Over the next year, Jessica achieved status of debt zero hero. Here is the strategy she used to do it, step by step.

How to Get Out of Debt

Get Serious.

Or even better, “Get obsessed,” Jessica advises. Money is a game of mastering your own psychology. The first step to achieving any life goal is to realize it is possible. Once her mind was made up, the rest of the process began to take care of itself.

Keep It Simple

Complicated systems will only make you feel overwhelmed and defeated. Try an online tracking system like Personal Capital.

While debt can feel like an impossible black hole, at the end of the day it comes down to numbers. So long as more income is coming in than going out, you’re already on the right track.

Track Your In vs. Out

‘That which gets measured gets managed.’

Humans fail, but systems succeed. Building systems gave Jessica awareness and control over her spending and earning behavior.

Tracking and data visualization can help you fall in love with automation and saving. Your path to wealth might be as simple as signing up for a program like Personal Capital or Mint.com.

Give every dollar a job

Take control. Don’t be afraid to boss your money around.

Every dollar should work for you, instead of the other way around. Some dollars will be employed towards food, and others to savings. Some dollars can even be unemployed to float away on something spontaneous and fun.

Just make sure you are calling the shots.

To do this, Jessica used the ‘Every Dollar’ app from Dave Ramsay, sharing the account with her fiance. Together, they tracked every dollar spent and stayed on budget, even making some room for fun at Disneyland.

Start with lowest first

Remember the ‘Debt Snowball’ Jessica stumbled upon?

Here’s how it works: To stay motivated, you will need quick wins. Paying off your lowest debt first will give you a hit of victory. That sense of satisfaction is key to remembering paying down all of your other debts is equally possible.

It sounds logical to pay off the debt with the highest interest first. It might even be tempting to invest, knowing that money in the stock market might have a higher return than your interest.

Avoid this trap. Manage your mindset first. It is more critical you reduce your sources of debt and build a momentum of quick wins.

If you want to try the classic ‘Snowball’ method for yourself, here’s how:

- Step 1: List your debts from smallest to largest regardless of interest rate.

- Step 2: Make minimum payments on all your debts except the smallest.

- Step 3: Pay as much as possible on your smallest debt.

- Step 4: Repeat until each debt is paid in full.

Try the ‘No Buy’

What do you really want? What do you need? The ‘no buy’ challenge is eye opening to determine both.

The self explanatory experiment involves no spending for a week or even a month. It is the perfect solution to clean out pantry clutter. Finally, you can purge that quarantine pasta panic buy, or those five garbanzo bean cans collecting dust.

Some even take it to further extremes by swearing off non-essential items (clothing, beauty, electronics) for an entire year.

If this sounds daunting, start small. Simply vow to let your Amazon cart sit for 24 hours before clicking the ‘Checkout’ button. Then, check in the next day to ask yourself: Did you really want it anyway?

Just taking this moment to pause and reflect will build your discipline and mindfulness muscles.

Side Hustle

Jessica went into business again, but this time for herself as 100% owner. She translated her beauty and makeup skills into a makeover business for high school students attending prom.

She also put her expertise and passion for working with animals to use as a pet sitter. It wasn’t always easy or fun, but it paid off.

Grant Sabatier also achieved Millennial Millionaire status by respecting the side hustle.

To build a seven figure savings by age thirty, he wasn’t above taking side cat sitting gigs, even though he was allergic to cats and running a full service ad agency by day.

Don’t be afraid to tap into your skills to pay the bills, whether that means offering your expertise as a coach, flipping domains at auction, hosting a garage sale, and so much more.

Make It a Game

Budgeting and saving can even be…dare I say it – enjoyable? Treat the process like a video game where you can score, win, and earn points.

Having a partner in crime can also help tremendously. Jessica and her husband-to-be got competitive with another over who could stay most on top of saving and tracking.

Focus on Your Network and Team Up

‘Your network is your net worth.’ This doesn’t just apply to aspiring careerists looking for connections on the corporate ladder. Your personal network is an invaluable resource for trading, selling, borrowing, and support.

Whenever possible, recruit an ‘accountabil-a-buddy’ for any audacious goals.

In Jessica’s case, her debt journey caused her to build a digital network. She joined ‘Buy Nothing’ groups on Facebook. Instead of whipping out her wallet, she would look to local community resources first. She also expanded her network to sell old stuff or explore new client opportunities through sites like Craigslist, Marketplace, and NextDoor.

Who needs cash when you’ve got great friends?

Tell yo’ wife, tell yo’ kids

You might have noticed all of these public Instagram posts Jessica was making to her friends and family. This wasn’t done on a whim.

She wasn’t sure how her effort would be received. Would people be resentful? Judgemental? Jealous? Turns out, none of the above. In fact, she was met only with unwavering support and enthusiasm.

Publicly announcing her goals kept Jessica feeling accountable, while serving as a powerful visual progress indicator.

Revealing your goals to your community might feel scary at first, but is well worth it. Going public gives you skin in the game. Avoiding public defeat is a powerful motivator to keep on course. More importantly, it will cause you to self-identify as someone who is financially motivated and successful.

If you do receive any backlash from friends or followers, this might be an indication that they find your success threatening. Sometimes growing into a new life, means leaving behind the old one. And, anyone who isn’t supportive of your goals might have never actually been a friend in the first place.

Meditate and Visualize

Inevitably, Jessica faced a dark night of the soul while summiting her debt mountain.

Working full time, side hustling, planning a wedding, and tracking every penny is a lot of moving piece. She could feel the stress and overwhelm begin to teeter on depression.

She wisely sought help with a therapist who wrote her a prescription for ‘meditation’.

Jessica confessed she never thought her journey would take that turn. “Anytime someone preached meditation to me I’d be like, ‘Move along, hippie,’”

Jokes aside, she found an accessible practice through the book ‘Stress Less, Accomplish More,’ a guide for those of us who struggle to find time for chanting on a mountaintop.

Practicing meditation helped Jessica stay focused, calm, and productive. She also discovered visualization as a tool to stay motivated and tap into the exciting possibilities for her future.

Now that Jessica is debt free, a noticeable weight has been lifted. She radiates with a glow of accomplishment and optimism for the future.

So what’s next after debt obliteration?

Long term, Jessica visualizes a beautiful farm house in the mountains, surrounded by family. But for now, she is building the Robeson empire one brick at a time, starting with a solid emergency fund.

What is it like to be Debt-Free?

Now that Robeson tells her money what to do instead of the other way around, she is truly unstoppable.

We can’t wait to see what she’ll do next.

Avoiding Debt in the First Place

Taking on debt is not something to be taken lightly. Jessica also adds that the best way to become debt free, is to avoid bothering with it in the first place.

Looking back, her are a few things she wish had known when considering her education options.

1. Research your profession and earning potential.

Do you even need a degree? What Robeson didn’t know when she entered college was that a degree in Science and Biology wasn’t particularly lucrative without aspirations for a PhD.

Education is important, but where you attend school matters less than people think. Attending community college for a few years and transferring to a brand name school can make a major difference.

2. Start budgeting, saving, and paying off loans in college.

Do your future self a favor and start paying yourdebt down immediately. The sooner your pay off your debt, the sooner you won’t have to burn money on Interest, and can start saving and investing instead.

Get Out of Debt – TL;DR:

1. It starts with mindset.

The only thing to focus on, is getting out of debt as soon as possible.

2. Keep it simple, sexy.

Remember the acronym K.I.S.S. (Keep It Simple, Sexy) and you can KISS your debt goodbye.

3. Track everything.

Rely on systems. Don’t be defeated if you slip up. That which gets measured gets managed. Click here to signup for a Personal Capital account and get started.

4. Put your money to work.

The only reason you should work for money, is so money can then work for you 😉

5. Focus on the lowest debt first.

Use the ‘Snowball’ effect for gratify quick wins to keep you on task.

6. Take the ‘No Buy’ Challenge.

Build your will power muscles with mindfulness and spending ‘fasts’.

7. Try a Side Business.

Ramp up your progress by starting a side business.

8. Make it a game and team up.

Think of it like a long game of monopoly, and recruit an accountability partner to play.

9. Make it public.

Build a network and seek community support.

10. Visualize and meditate.

Stay cool, calm, and collected by imagining your goals come to life.

11. Be strategic.

Avoiding debt in the first place is best. If you decide to take on debt, start budgeting and paying it down immediately.