Table of Contents

Wondering the secret on how to become rich? It all starts with mindset. There are a lot of toxic money myths out designed to keep you broke.

If you are ready to achieve your financial goals, here are the money mindset myths you need to stop telling yourself right now.

Myth #1. “Getting rich is up to luck”

Rich people seem to credit their success on luck a lot, perhaps due to imposter syndrome or just trying to stay humble.

To become lucky, you have to repeatedly throw yourself in the way of luck. The opposite of putting yourself in the way of luck is wallowing around squarely inside your comfort zone.

If you define wealthy as reaching a net worth of over 1 million dollars, it is true that most people will not become wealthy. About 3% of Americans are millionaires. But, that doesn’t mean you can’t stack the odds in your favor.

The chances of rolling dice on a 12 are also about 3%, or about 1 in 36. But, the more you roll the dice, the higher your chances of rolling that 12 become.

Most of the ‘lucky’ people I know had to roll the dice at least a few times. Maybe they did it by purchasing an investment property, starting a blog, or applying for a big time job on a whim or a prayer.

At the very least, these people became ‘lucky’ by getting obsessed: with a goal, with taking a calculated risk, or deeply cultivating a skill or education.

There ARE actionable, measurable steps that ANYONE can take if they want to become wealthy:

- Improve your credit score

- Avoid debt

- Save your money

- Live below your means

- Open up a retirement account

- Invest consistently

- Continue learning

- Improve your habits

- Don’t give in to lifestyle inflation

Myth #2. “There is a ‘happiness’ salary”

Between $25,000 to $180,000 a year, here is the exact salary that has made me the happiest:

$0.

Why? Because I was self employed and allowed to do whatever the f*ck I felt like. Who wants golden handcuffs when you could have no handcuffs?

As Nassim Nicholas Taleb wrote:

“The three most harmful addictions are heroin, carbohydrates, and a monthly salary.”

I guess it’s a good thing Taleb is a world renowned risk analyst and not a nutritionist because carbohydrates are a nutrition component critical to our survival. But I digress.

Salaries (and day jobs) are designed to keep you poor.

Why?

Employers know that if they pay you enough to make you rich, you might quit and go retire on a beach somewhere.

When I was making the ‘happiness’ salary of $75-100,000 a year – I was miserable and working round the clock stressed out and exhausted.

I became truly happy when I learned:

- How to stop striving for the next level, and live far within my means

- The beauty of meditation, stoicism, and self discipline

- 80% of the ‘stuff’ I owned was only weighing me down

- Investing in myself or something I was building from scratch was the most rewarding way to spend my income

Who cares what your salary is? You should be more concerned with your savings rate. If you make $230,000 a year, and spend $235,000 a year, you are poor my friend.

If you make $45,000 a year, and save $25,000 a year, you are richer than that doctor down the street who just plunged their salary on a new car off the lot.

Myth #3. “Getting rich is a miserable grind”

Actually, staying poor is a miserable grind. Also, the chances you will become rich doing something you hate are extremely slim. It is true that becoming wealthy often comes down to strong effort. You are more likely to put that strong effort into something that makes your heart sing with joy.

“You can fail at what you don’t want, so you might as well take a chance on doing what you love.” – Jim Carrey

Most wealthy became that way because they found something that excited them and aligned with their greater purpose.

Taking action and putting in the effort is definitely a key to success. But I can also think of a lot of people who work extremely hard and never get ahead. Can you?

Taking calculated risk, investing consistently, finding ways to contribute value, and thinking strategically can get you much farther to your financial goals than simply working hard.

I once worked with someone who was a total workhorse. Whatever she was told to do, she would do it for ten hours a day non-stop. But she would never pause and ask ‘What is the pay off?’As a result she would burn herself out with very little results to show for it.

If you spend ten hours a day doing something that produces no results, how can you ever get ahead?

On the other hand, many wealthy people I know have become successful by delegating tasks they don’t want to other people, while focusing on the big wins responsible for the largest output.

Myth #4. “You’ll never get rich at your day job”

Didn’t I just complain about how companies benefit by keeping you poor? Yes. Yes I did.

I also know that if it weren’t for the decade I spent in a J-O-B, I wouldn’t have built up the savings I need to start investing. I wouldn’t have been introduced to concepts like retirement accounts.

My corporate career gave me insight into important factors that make companies successful, ultimately contributing to my investing savvy.

The F.I.R.E. movement (Financially Independent, Retire Early) proves that you absolutely can get rich slowly, or even quickly, even on a teacher’s salary.

The key is to save ruthlessly and invest aggressively. After that, it is just a matter of time and compounding interest. It takes time and extreme dedication, but it’s a very possible proven process.

Myth #5. “The average person can’t become rich”

Actually, most millionaires ARE everyday people. Don’t believe me? Read ‘The Millionaire Next Door’.

You might wonder how can it be that the mechanic living in a humble house driving a used car is actually the portrait of American wealth?

It makes ya think. Does that mean people who brag about being rich are actually just peacocking the appearance of success to compensate for deep rooted insecurity?

In my experience, the richer people become, the less likely they are to tell you about it. Why? I can give you a million reasons.

No on wants to come across as a braggadocio, invite awkward requests from friends, family, and random strangers asking for a loan, or become a target for jealousy or theft.

If you want to find the invisible millionaire next door, look for someone who:

- Lives well below their means.

- Is careful and strategic in selecting opportunities and occupation.

- Rejects status symbols and wealth displays.

- Is a small business owner or first generation self made.

The quality shared by the majority of millionaires is the ability to live far below their means.

Myth #6.”There is no ‘formula’ for how to become rich”

Wrong. The formula to wealth is, invest $200 a day (or $6000 a month) in broad market ETFs for ten years at an 8% average return to become a millionaire in a decade. Click here to read about how to get started on that.

If you have twenty years to spare, you can invest $3000 a month, or $100 a day. $1500 a month ($50 a day) will take you 40 years.

By the way, this is the easiest, bare minimum, financial independence for dummies method to millions. There are a million and one ways to accelerate this growth.

Myth #7. “Rich people are evil”

The truth is, bad and good people can become rich.

The chances are, money will just make you more YOU. If you are a kind and generous person when you get rich, you will probably continue to be kind, happy, and generous. If you are a horrible person, you will probably get even worse.

But what about all of those awful scam artists who like to flash their lambos on YouTube commercials?

1. Those people aren’t necessarily rich. If they were, why would they need to sell you a course?

2. Yes, sometimes horrible people get ahead – but it usually isn’t permanent. Eventually people’s deeds catch up with them.

“Your level of success will rarely exceed your level of personal development because success is something you attract by the person you become.”

― Jim Rohn, The Miracle Morning

You tend to get back what you put out. If you put value out into the universe, you will receive value back.

Speaking from personal experience, the more I worked on my kindness, gratitude, and self discipline, the more wealth I have been granted.

Myth #8: “Money doesn’t buy happiness”

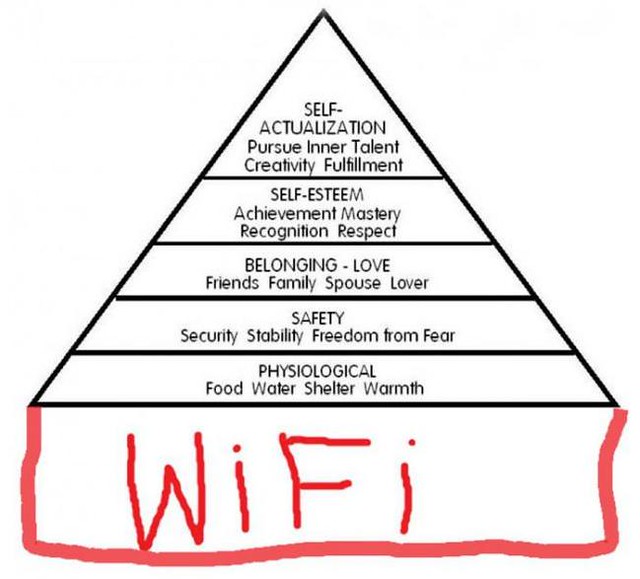

Truth: Most people are bound to be happier once their basic hierarchy of needs is being met.

This always strikes me as a privileged thing to say. If you are wealthy enough to claim money doesn’t buy happiness, you’ve probably never felt the pain of sacrificing time with your kids to work late, or the cold sweat of panic when a debt collector comes calling.

Money buys freedom, and freedom makes people happy. The good news is, if you truly long to be free, there are ways to get there without a big bank account. But it certainly does help.

Here are a few examples of when money can buy happiness:

- Leaving behind toxic roommates to move into your own place

- Escaping a corporate job to retire or work for yourself

- The luxury of a parking ticket being a simple, fixable mistake, instead of escalating into a life ruining consequence or expensive court drama

- Buying healthy food at the grocery store without stressing over the final bill

However, money does not buy fulfillment. Fulfillment is the feeling that comes from contributing value to the world and other people. Fulfillment is probably what you were actually seeking all along.

Comments are closed.